boulder co sales tax return

Returns must be postmarked on or before the due date to be considered on time. Report any tax due on your next return.

National Report Hits Delegation In Boulder With A Dose Of Reality Tallahassee Reports

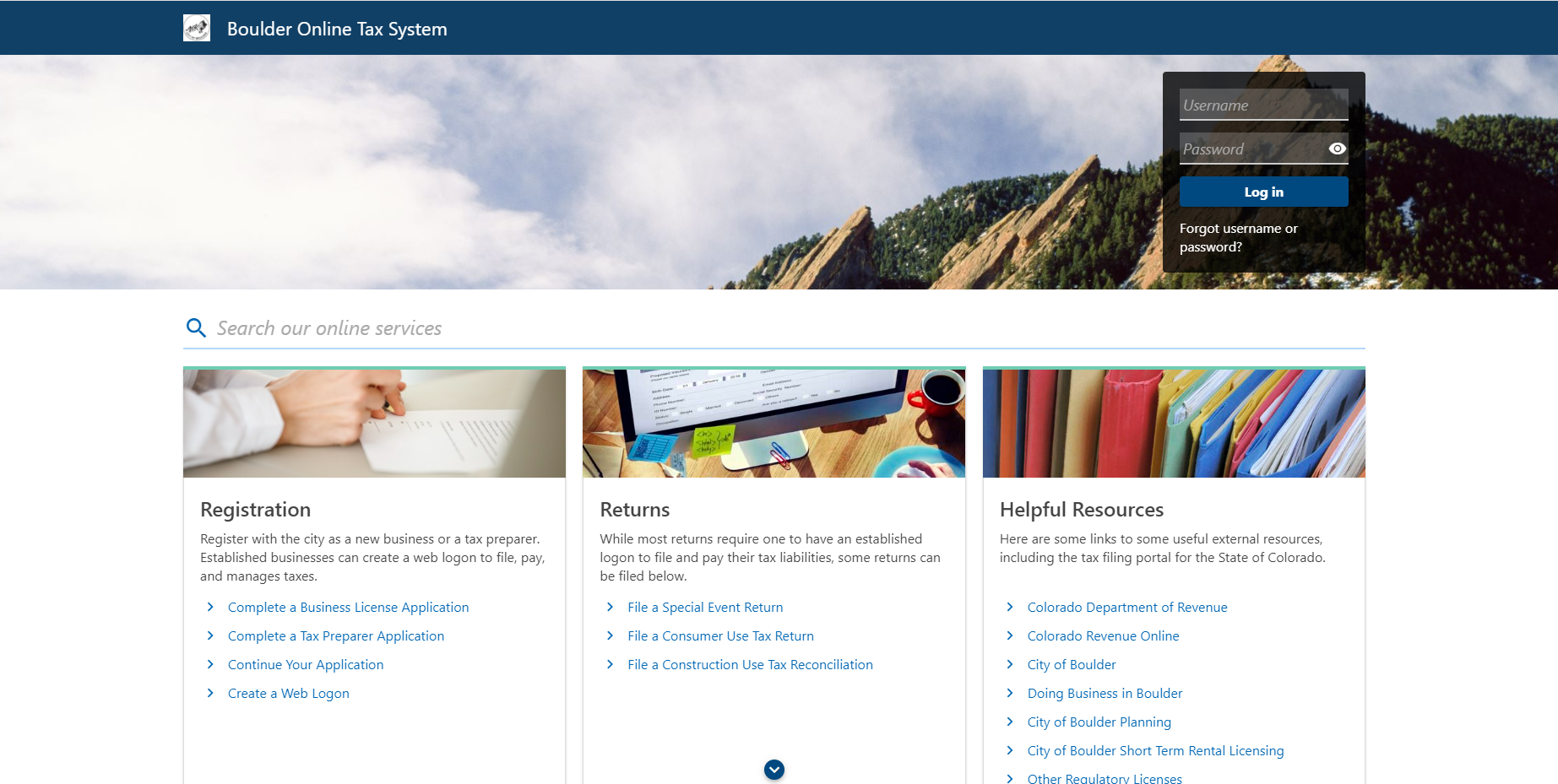

File online tax returns with electronic payment options.

. You will receive useful tips for easier submitting. The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to. There are a few ways to e-file sales tax returns.

Sales tax returns are due the 20th of the month following the month reported. Under 300 per month. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax.

If only County RTD and State taxes 4985 were collected then the City use tax rate of 386 is due and payable to the City of Boulder. New for 2022 tax yearBoulder County is using a new Online BPP Filing system. The example below shows that City sales tax was not collected and is therefore due as use tax.

A tax return must be filed even if taxes are not due. Complete a Business License application or register for a Special Event License. Taxpayer name and address mail to.

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. Sales tax returns may be filed annually. DR 0100 - Learn how to fill out the Retail Sales Tax Return DR 0100.

The Boulder sales tax rate is. CR 0100AP - Business Application for Sales Tax Account. For additional e-file options for businesses with more than one location see Using an.

Please remember Boulder County taxes are paid to the Colorado Department of Revenue CDOR. For tax rates in other cities see Colorado sales taxes by city and county. This is the total of state county and city sales tax rates.

15 or less per month. This is the total of state county and city sales tax rates. Once registered filers will receive an emailed registration confirmation containing a request to set up a.

You can print a 8845 sales tax table here. Sales tax returns may be filed quarterly. Sent direct messages to Sales Tax Staff.

Colorado state sales tax is imposed at a rate of 29. 13 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax. Visit the Boulder Online Tax System Help Center for additional resources and guidance.

Annual returns are due January 20. Cdor collects the sales tax from business on behalf of boulder county. If the 20th falls on a holiday or a weekend the due date is the next business day.

DR 0154 - Sales Tax Return for Occasional Sales. If you have any difficulties switch on the Wizard Tool. The minimum combined 2022 sales tax rate for Boulder Colorado is.

Repeating info will be filled automatically after the first input. Boulder Online Tax System. Fill in the info required in CO Sales Tax Return - City of Boulder making use of fillable fields.

The minimum combined 2022 sales tax rate for Boulder Colorado is. Include photos crosses check and text boxes if it is supposed. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online.

Longmont sales tax division 350 kimbark st longmont co 80501. Colorado Sales Tax Guide Sales tax. Filing frequency is determined by the amount of sales tax collected monthly.

Use Boulder Online Tax System to file a return and pay any tax due. If you cant find what youre looking for online contact Sales Tax staff at salestaxbouldercoloradogov. If you have more than one business location you must file a separate return in Revenue Online for each location.

The Colorado sales tax rate is currently. Historical Sales Tax Rates for Boulder 2022 2021 2020 2019 2018 2017 2016. DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR 0103 - 2022 State Service Fee Worksheet.

Wayfair Inc affect Colorado. Did South Dakota v. Sales and Use TaxFinancial Services.

DR 0235 - Request for Vending Machine Decals. Sales tax returns are due the 20th of. FID Taxable sales times 01 0001.

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. What is the sales tax rate in Boulder Colorado. For information related to specific tax issues for state county or RTD please contact the.

Any sale made in Colorado may also be subject to state-administered local sales taxes. To start the filing process filers must first register their contact details using the link above. File Sales Tax Online Department of Revenue - Taxation.

DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business. The County sales tax rate is. Businesses register with cdor to determine what taxes to pay.

Boulder Eyes 5 2m Purchase Of Historic Poor Farm Property For Open Space Boulder Daily Camera

Sales Tax Campus Controller S Office University Of Colorado Boulder

Getting Your Business Established In Boulder Colorado

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Class Specifications Sorted By Classtitle Ascending Boulder County Careers

Orbea To Move Us Operations To Boulder Colorado Pinkbike

How Cu Boulder Is Funded Budget Fiscal Planning University Of Colorado Boulder

Boulder Skyline Art Print Boulder Decor Colorado Flatirons Etsy

Sales Tax Campus Controller S Office University Of Colorado Boulder

Construction Use Tax City Of Boulder

Short Term Dwelling And Vacation Rental Licensing Boulder County

Sales Tax Campus Controller S Office University Of Colorado Boulder

Colorado Wildfire Forces Evacuation Orders For 19 000 People